Unlock new financial opportunities with SimplyTokenized’s secure, compliant, and innovative services.

Tailored Tokenization Solutions for Corporate Growth

Managing tokenized assets, investors, and regulatory requirements can quickly become overwhelming without the right tools. Businesses need an all-in-one solution to simplify these processes and maximize the potential of tokenization.

Problem:

You’ve tokenized your assets or are planning to, but managing everything—from investor onboarding to regulatory compliance and payment processing—is time-consuming and complex. Without a unified system, inefficiencies and errors can slow down your progress and erode investor trust.

Solution:

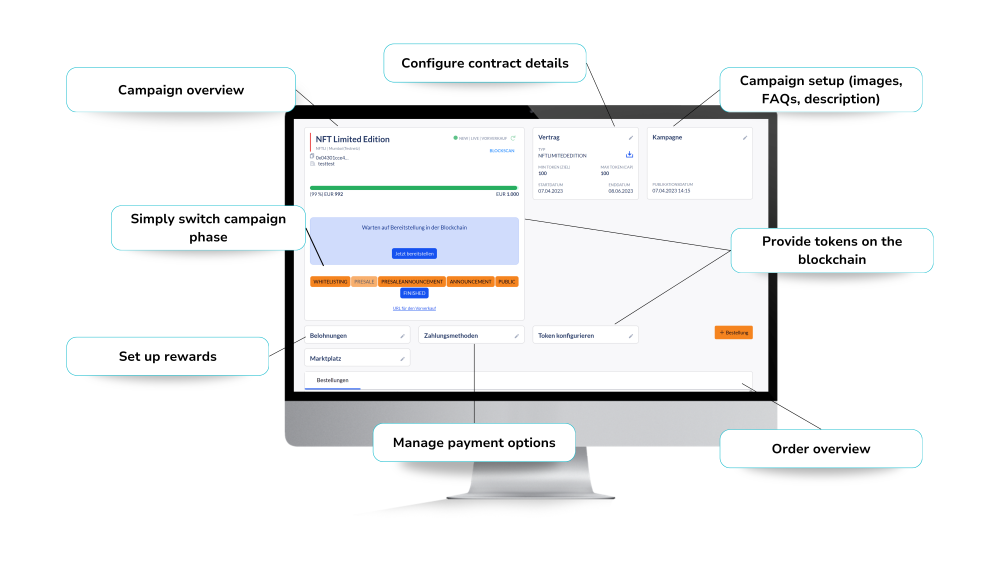

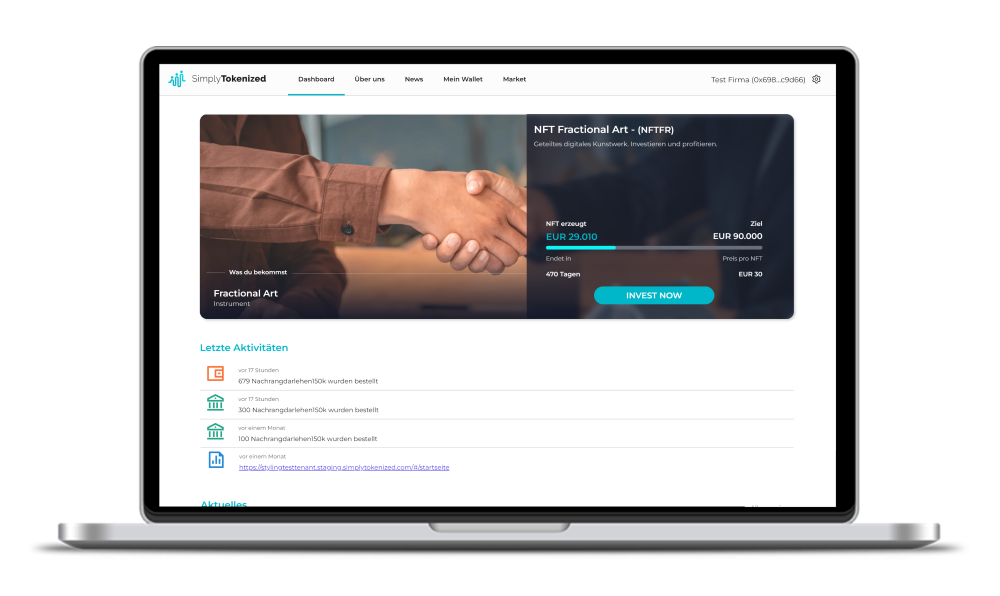

The SimplyTokenized Platform is a comprehensive solution that streamlines every aspect of tokenization. It provides businesses with the tools to manage their tokenized assets, engage with investors, and stay compliant with regulatory standards—all in one secure, easy-to-use platform.

|

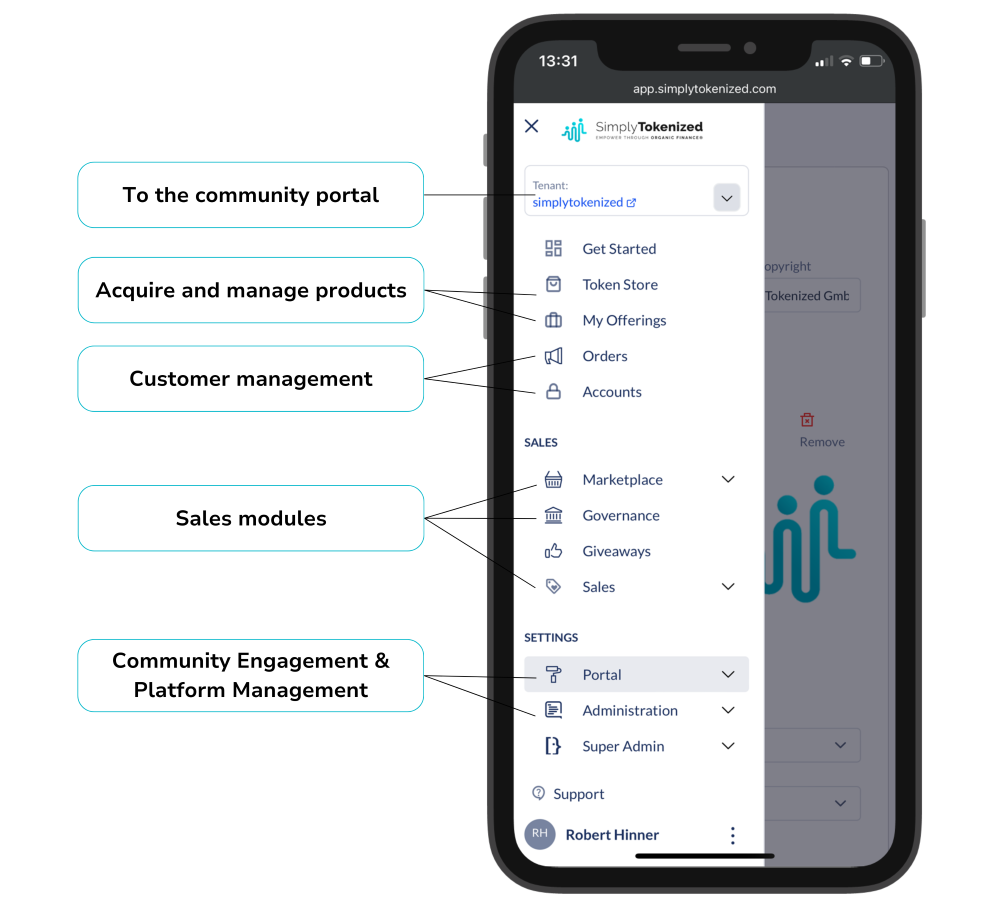

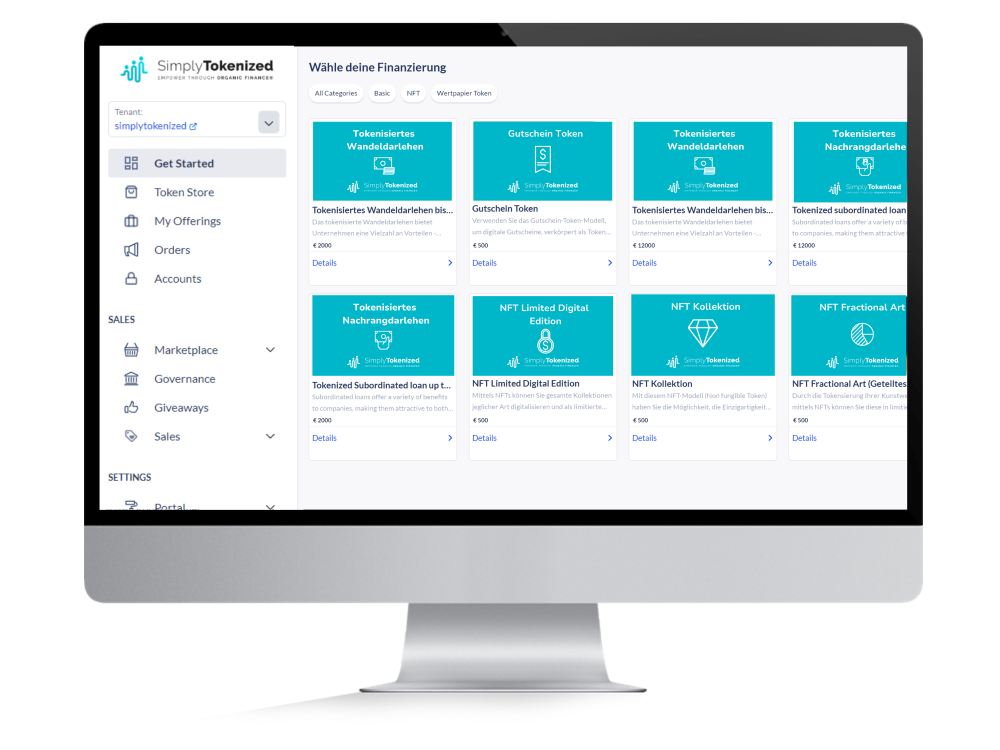

One platform – many possibilitiesOur SaaS solution offers companies a comprehensive company portal to create and manage financing products, customer management and individual marketing activities, while the community portal gives investors access to a personal dashboard, profile and company content. An all-in-one solution for effective crowd investing and strong community ties. |

Selection of financing in the integrated store

|

|

|

Individual setup of the community portal

|

Community portalYour customizable area for your community, where your campaigns are supported, wallets are created and internal announcements are published.

|

|

Key Features:

- Investor Onboarding and Management: Effortlessly onboard and manage your investors with a seamless interface and built-in compliance checks.

- Asset Token Management: Issue, distribute, and track tokens in real time with full transparency.

- Payment and Dividend Automation: Automate payments, dividends, and returns with blockchain-enabled smart contracts.

- Regulatory Compliance Tools: Stay on top of regulations with integrated legal frameworks and monitoring systems.

- Analytics and Reporting: Gain actionable insights into asset performance, investor engagement, and market trends.

Result:

- Efficiency: Consolidate operations into one platform, saving time and reducing errors.

- Investor Trust: Provide a professional and transparent experience for your investors.

- Scalability: Easily manage growing portfolios and investor bases as your business expands.

Example: A property management company uses the SimplyTokenized Platform to manage tokenized ownership of multiple real estate projects, automate dividend distributions, and provide investors with real-time performance updates.

Businesses often face challenges when trying to unlock the full value of their assets. Traditional methods, such as selling or taking loans, are rigid and often exclude smaller investors. Assets like real estate, commodities, or intellectual property are valuable but lack liquidity, limiting growth opportunities.

Problem:

You have an asset worth significant value, but it’s locked—meaning you can’t easily sell a portion, access capital, or involve a broader investor base. Traditional finance options are either too slow, too expensive, or too restrictive. You need a modern way to make your assets work for you.

Solution:

Asset tokenization transforms physical or intangible assets into digital tokens stored on a secure blockchain. These tokens represent fractional ownership, allowing you to raise funds by selling portions of your asset without giving up total control. Investors, in turn, gain the ability to buy and trade these tokens, creating liquidity and flexibility.

Result:

- Liquidity: Access immediate funding without selling your entire asset.

- Accessibility: Attract a diverse pool of investors, from large institutions to individuals worldwide.

- Transparency: Blockchain records every transaction, ensuring trust and security.

Example: A property owner tokenizes a $10M building into 10,000 tokens. Each token is worth $1,000, enabling smaller investors to own a share while the owner retains control over the property.

Raising capital is critical for business growth, but traditional financing often comes with high costs, complex processes, and limited access to global investors. Modern businesses need faster, more inclusive options to secure funding.

Problem:

You need capital to grow your business, but loans, IPOs, or private placements are either too costly or take too long. You’re losing out on opportunities while being tied to outdated systems that don’t cater to a global investor base.

Solution:

Tokenized corporate financing introduces digital bonds, equity, and hybrid instruments that can be offered to a global market. By using blockchain technology, these instruments become more secure, accessible, and efficient, allowing you to raise funds faster and reach investors anywhere in the world.

Result:

- Cost-Effectiveness: Reduce fees and administrative overhead associated with traditional finance.

- Broader Reach: Attract investors from different geographies and demographics.

- Trust: Blockchain ensures transparency and security, giving investors confidence in your offerings.

Example: A tech startup raises $5M by issuing tokenized equity to investors globally, bypassing traditional VC constraints.

Tokenization offers exciting opportunities, but it also introduces complex legal and regulatory challenges. Ensuring compliance is essential to avoid risks and build trust with investors and stakeholders.

Problem:

Navigating the maze of global regulations, such as MiCA or other regional standards, can be overwhelming. Without proper compliance, your project risks legal disputes, financial penalties, or investor distrust. You need expert guidance to make sure your tokenization journey is smooth and lawful.

Solution:

Our compliance and legal advisory services provide end-to-end support, from understanding regulatory frameworks to drafting legal documents. We ensure that your tokenized assets adhere to regional and international laws, giving you a strong foundation to operate securely and confidently.

Result:

- Risk Mitigation: Avoid legal pitfalls by staying compliant from the start.

- Investor Confidence: A compliant project builds trust and credibility among your stakeholders.

- Operational Ease: Focus on your business while we handle the legal complexities.

Example: A real estate company tokenizes a luxury apartment complex, ensuring its offering complies with MiCA regulations to attract European investors.

Blockchain technology has the potential to revolutionize how businesses operate, offering transparency, efficiency, and security. However, many businesses struggle to integrate this technology into their existing systems.

Problem:

You want to improve your business operations by adopting blockchain, but you’re unsure how to implement it. Existing systems are siloed, inefficient, or prone to errors, and integrating blockchain seems complex and intimidating.

Solution:

We provide tailored blockchain integration services that align with your business needs. From smart contract development to implementing secure token management platforms, we ensure a seamless transition to blockchain-powered systems.

Result:

- Transparency: All transactions are recorded on a blockchain, creating a reliable and tamper-proof ledger.

- Efficiency: Automate processes like payments, ownership transfers, and inventory tracking.

- Future-Ready: Position your business to thrive in a digital-first economy.

Example: A retail company uses blockchain to create a loyalty program where customers earn digital tokens that can be redeemed or traded seamlessly.

The Future of Corporate Finance

Unlock new revenue streams through asset liquidity.

Build trust with transparent, blockchain-based transactions.

Attract global investors with fractionalized ownership.

SimplyTokenized

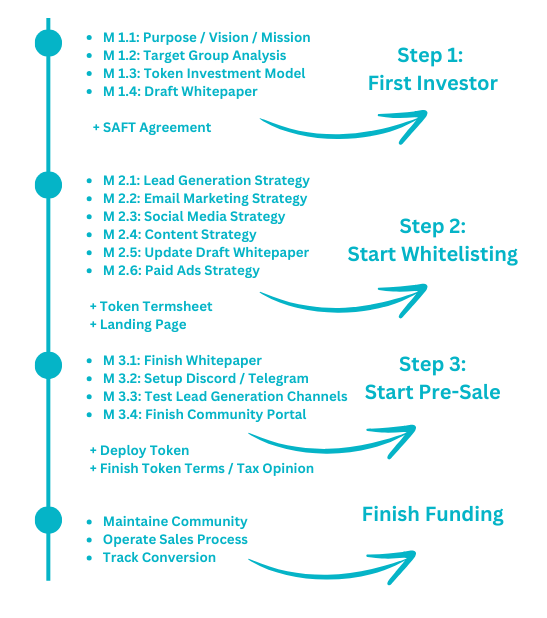

Build & Learn Process

The SimplyTokenized Build & Learn process is a comprehensive, step-by-step framework designed to help businesses seamlessly integrate tokenization into their financial strategies. It combines strategic guidance, tailored implementation, and iterative learning to ensure a smooth transition into the tokenized economy. This process focuses on empowering businesses with the tools, knowledge, and confidence to build a robust tokenization model while adapting to market dynamics.

Flexibility in Approach:

The Build & Learn process is designed to accommodate your unique needs. You can choose between a full-service approach, where SimplyTokenized handles the end-to-end process, or a modular approach, allowing you to select and implement specific modules based on your business priorities.

Steps in the Build & Learn Process

Step 1: Strategic Foundations:

Establish a solid understanding of your business needs and tokenization goals.

Step 2: Marketing and Engagement Preparation:

Create a strong foundation for investor engagement and community building.

Step 3: Community and Platform Launch:

Activate your investor community and launch the tokenization platform.

Step 4: Iterative Learning and Optimization:

Adapt and improve based on real-world performance and feedback.

Key Benefits of the Build & Learn Process

- Structured Progression: Provides a clear roadmap from initial planning to full token deployment and scaling.

- Tailored Solutions: Ensures every step is aligned with your specific business goals and industry needs.

- Continuous Learning: Encourages iterative improvements based on market insights and investor feedback.

- Expert Support: Access to a team of blockchain, compliance, and marketing professionals for guidance.

FAQs About the Build & Learn Process

What is the difference between the full-service and modular approaches?

The full-service approach provides end-to-end support, handling every step of the process for you. The modular approach allows you to select individual steps, such as marketing setup or community building, based on your immediate needs.

Who is the Build & Learn process designed for?

The process is ideal for businesses across industries, including real estate, commodities, consumer ventures, and tourism, that want to explore tokenization for raising funds or engaging investors.

How long does the process take?

The timeline varies depending on the selected approach and complexity of your project but typically spans a few months to ensure thorough preparation, launch, and optimization.

Do I need technical expertise to participate?

No, SimplyTokenized provides expert guidance at every step, from strategy to execution, so no prior blockchain or tokenization knowledge is required.

FAQs About the SimplyTokenized Platform

What is the SimplyTokenized Platform?

The SimplyTokenized Platform is an all-in-one solution for managing tokenized assets, investors, and regulatory compliance. It streamlines the process of issuing, tracking, and distributing tokens, while providing tools to engage with investors and automate payments.

What is the SimplyTokenized Platform?

The SimplyTokenized Platform is an all-in-one solution for managing tokenized assets, investors, and regulatory compliance. It streamlines the process of issuing, tracking, and distributing tokens, while providing tools to engage with investors and automate payments.

Who can use the platform?

The platform is designed for businesses of all sizes and industries, including real estate, commodities, consumer ventures, and tourism. Whether you’re tokenizing equity, debt, or physical assets, the platform caters to your needs.

How does the platform handle regulatory compliance?

Our platform integrates legal frameworks and monitoring systems to ensure your tokenized assets meet regional and international regulations, such as MiCA. It also provides built-in compliance checks during investor onboarding.

Can I manage multiple tokenized assets on the platform?

Yes, the platform supports managing multiple tokenized assets, allowing you to issue, track, and distribute tokens across various projects seamlessly.

How does the platform enhance investor engagement?

The platform provides a user-friendly interface for investors to access performance data, track their holdings, and receive automated payments or dividends. This transparency and ease of use build trust and engagement.

Can the platform integrate with my existing systems?

Yes, the platform is designed for flexibility and can integrate with your existing business systems to streamline operations further.